The holidays are here. If you are anything like me, the calendar is filling up with events and festivities, your holiday to-do list is growing, and you are starting to think about Christmas shopping.

The holidays are here. If you are anything like me, the calendar is filling up with events and festivities, your holiday to-do list is growing, and you are starting to think about Christmas shopping.

Discounts and sale offers for black Friday and cyber Monday are filling up your inbox and the holiday shopping alerts abound.

Only 5 Saturdays until Christmas…

Offer expires in 24 hours!

Don’t miss out on this amazing deal!

32 days until Christmas and counting…

It is easy to get swept up in the excitement and anticipation of the holiday season and spend way more money on gifts and holiday splurges than you intend. Here are three ways to keep your Christmas shopping in check this holiday season.

[1] Make a plan

This can be quick, back of the napkin kind of plan, but write it down.

If you’ve ever walked into a store to buy a gift for someone but had no idea what you were seeking, you’ve probably had the same experience I did. Buying way too many items and not ever finding the “just right” item. Not only did I spend more than I wanted, I didn’t feel good about the gift either. Ugh.

Make a quick list of everyone receiving a gift from you.

Determine the total amount you plan to spend on gifts.

Allocate a dollar amount to each recipient.

If you already have ideas for certain gifts, it may be easier to work backward.

[If you know exactly what you are getting for your brother with an $80 price tag, write this one down first and then allocate the remaining dollars amongst your list.]

Now you have some guardrails in place as you start your shopping. And if you find some great deals after Thanksgiving and knock out all your stocking stuffers for less than planned, you’ve got extra cash to reallocate to another gift or donation.

[2] Use an app to stay on track

For the last two years, I’ve used an app to help keep track of our Christmas shopping. There are several out there. I use a free one called Christmas Gift List. No affiliation, I just find it useful and easy to use.

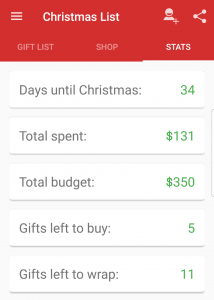

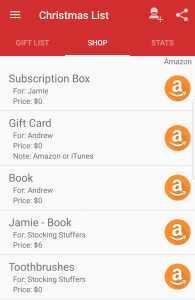

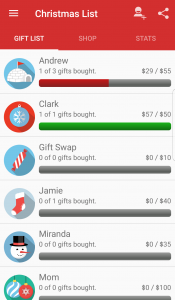

The app allows you to create your gift recipient list and enter a spending amount for each one. Then for each person, you can create a list of items to be purchased and mark items off as you buy. Here are a few screenshots:

As I’m making the purchases, I enter the cost of each item and the app tracks how I’m doing against my plan – both by individual giftee and overall. You can also track whether or not each gift has been wrapped.

Anyone else ever left their wrapping until Christmas Eve and found yourself elbow deep in wrapping paper in the wee morning hours? Yeah, me neither.

Using the app is helpful especially since I tend to buy a few things here and a few things there, especially for stocking stuffers, which are a long-standing tradition in my family. Our stocking stuffers almost always include toothbrushes [don’t ask, I have no idea when or why this started] and one year I bought a bunch on sale way before Christmas, promptly stashed them and forgot about it, only to buy a second set of toothbrushes for our crew in December. The only thing less exciting than a toothbrush in your stocking on Christmas morning is two of them.

The app makes it easier for me to keep track of the piecemeal shopping that’s done over the course of a few weeks and provides at-a-glance feedback on how we’re doing on spending.

Something to keep in mind:

This app isn’t designed to have multiple users accessing the same account. For instance, my husband can’t log in from his phone and update anything that I’ve set up in the app. For us, that’s no big deal because I do the bulk of our Christmas shopping. I just update the list with any shopping tasks he handles.

[3] Use a savings account to build your Christmas cash painlessly

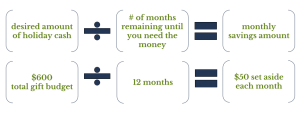

After a couple of Decembers where we overspent (mostly too many little things that really add up over time), we started using a Christmas savings account to help us plan and budget for the holidays. We add a small amount to the account each month so that when the holidays are upon us, we know we have the cash set aside for Christmas gift shopping and the other holiday extras.

It is really easy to overspend in November and December and then spend the first few months of the new year digging yourself out of a hole. Creating a savings account specifically for the holidays stops this cycle and takes away the financial stress that can accompany Christmas.

I realize that suggesting you set up a holiday savings account isn’t much help when the holiday season is already upon us, but I do encourage you to do this for next year. With online banking today, it is fairly simple to set up new accounts so get the account set up and commit to a monthly contribution amount. Better yet, make it automatic so you set it up once and that’s it. Holiday savings is happening throughout the year and you don’t even have to think about it.

We use CapitalOne360 ←referral link (you and I both get a bonus if you choose to open a qualifying account using the link) for all of our targeted savings accounts, including the Christmas fund. We like it for ease of use, no fees, and the ability to set up recurring automatic deposits into the account.

If you don’t want to set up your own account (DIY approach), many credit unions and some banks offer ‘Christmas Club’ accounts, which are promotional accounts that allow you to make small, recurring deposits all year, often at a higher interest rate than a regular savings account, and the funds in your account aren’t accessible (without a fee) until early November. Think of it as a built-in savings mechanism for the holidays.

Happy Shopping!

thanks for reading,

Lesley

The content of strongerwallet.com is provided for general information purposes and does not constitute professional advice regarding a specific situation. Readers should not act upon the content without first seeking appropriate professional advice about their specific situation.

Never miss a post

Thanks for reading!

Subscribe to get my latest content delivered to your inbox.

Leave a Reply